What is Singapore's Productivity Solutions Grant (PSG) and How to Apply for It (2020)

Get up to 80% off your POS costs by applying for the PSG

Contents

- What is Singapore's PSG

- Special COVID-19 Additions to PSG

- Is Your Business Eligible for the PSG

- How You Can Apply for PSG in 3 Easy Steps

- Can You Apply For Multiple PSG grants at Once

- What Documents Will You Need to Apply for the PSG Grant

- Receiving Approval and Deployment of Your New Solution

- Submitting Your Reimbursement claim

- Receiving Reimbursement

- Onsite Audit Requirements

What is Singapore's PSG?

In a bid to push Singapore forward into the future, the Productivity Solutions Grant (PSG) was created to aid Singaporean companies looking to adopt and deploy "IT solutions and equipment to enhance business processes."

The PSG is a grant that covers the "actual purchase/lease/hire cost of the pre-approved equipment or pre-approved IT solution package is supportable. This excludes other related administrative fees/charges, e.g. delivery fees, installation." The duration of these services must last for at least one year.

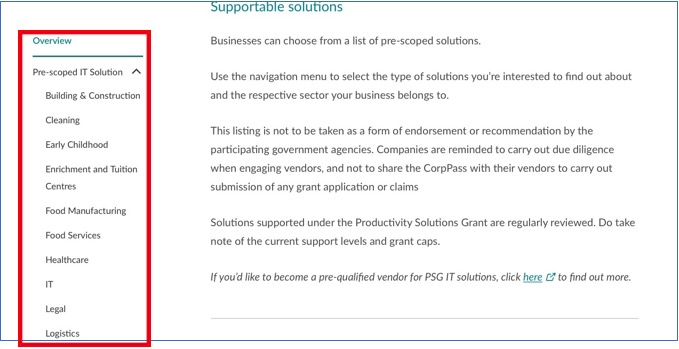

The PSG applies across multiple industries such as F&B, retail, logistics, precision engineering, construction and more. The PSG also supports cross-industry solutions such as "customer management, data analytics, financial management and inventory tracking."

The grant, itself, has actually been increased in certain cases as was stated in Singapore's Supplementary Budget 2020. The maximum funding amount for applicable IT solutions will be increased to 80% from 1 April 2020 to 30 September 2021.

Successful PSG grants will be dispensed 4-6 weeks after all the correct documents have been submitted and if the relevant application criteria is met.

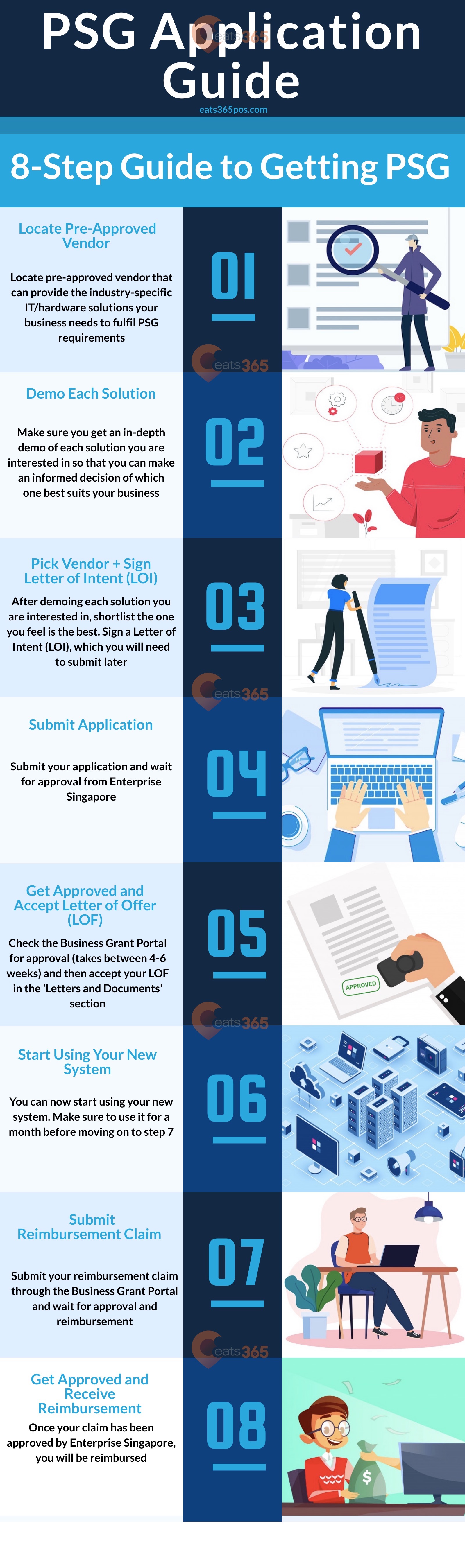

Make sure to locate a pre-approved vendor and test out multiple solutions before beginning the PSG application process.

Special COVID-19 Additions to PSG

As a special addition to businesses carrying out relevant COVID-19 business continuity measures, the following solutions will also be supported under the PSG (until December 31st, 2020):

Online collaboration tools (including laptop-bundled remote working solutions);

Virtual meeting and telephony tools;

Queue management systems;

Temperature screening solutions

Is Your Business Eligible for the PSG?

In order to be eligible to receive the Productivity Solutions Grant, your business must meet the following criteria:

1. Be registered/incorporated in Singapore

2. Have at least 30% local shareholders

3. Your business' annual sales turnover should not exceed SG$100 million, or should not surpass 200 employees

4. The purchase/lease/subscription for the IT solution or equipment must be utilized within Singapore

For PSG eligibility, your company must also NOT have done the following things:

1. Made any payment to the vendor/supplier in relation to the purchase/lease/subscription of the IT solution or equipment

2. Signed any contract with the vendor/supplier in relation to the purchase/lease/subscription of the IT solution or equipment

If your business qualifies as one of the following entities, it CANNOT apply for the PSG:

1. Charities, Institutions of Public Characters (IPCs)

2. Religious Entities

3. Voluntary Welfare Organisation (VWO)

4. Government agencies and subsidiaries

How You Can Apply for PSG in 3 Easy Steps

1. Access the list of supported solutions and search for the most relevant solutions for your business

2. For IT solutions: Get a quotation from a pre-approved vendor

For Equipment: get a quote for the equipment from a vendor

3. Submit your application on the Business Grants Portal (you will need a CorpPass account to fully-utilize the Business Grants Portal)

Can You Apply For Multiple PSG grants at Once?

Yes. You can apply for multiple PSG grants as long as you are applying for a grant that pertains to a different solution category. You can also apply for the same solution category if it is for a different location. It is not possible to receive a PSG grant for the same solution in the same business location.

What Documents Will You Need to Apply for the PSG Grant?

ACRA BizFile extracted within the last three months

Last three years of company finances. If you are a new company, you can leave this section blank

A quotation from the IT software / hardware vendor

Sign a LOI (Letter of Intent), which you will need for later. (The LOI should not lock you into committing to the vendor's quotation)

Receiving Approval and Deployment of Your New Solution

Enterprise Singapore will email you directly in 4-6 weeks after you have submitted your application. The response may indicate a successful application, failed application or require more information from your end.

Next, you should accept your LOF (Letter of Offer) at businessgrants.gov.sg

Changing your vendor after receiving approval is possible as long as the new vendor is an approved PSG vendor. You should write to Enterprise Singapore for confirmation.

Submitting Your Reimbursement claim

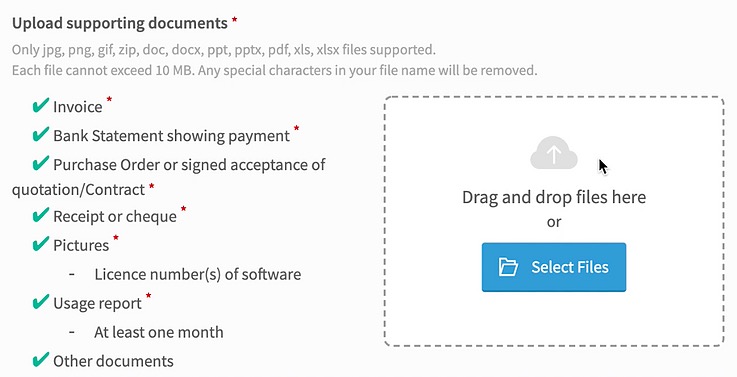

You must have used your new solution for a month before you can submit a claim. For example, if you have started using a new POS system, you should be able to extract the sales and transaction data for the last month to use as part of your claim. You will be asked for the 1 month usage report as a mandatory supporting document.

Prepare the following documents and upload them to the Business Grant Portal for your claim to be successful:

Solution/hardware Invoice, Bank Statement showing payment, Letter of Intent (Purchase order or signed acceptance of quotation/Contract), Receipt / Check, Picture of the Solution / hardware (with serial no), Software license number, Usage report (at least one month)

Receiving Reimbursement

Once your reimbursement claim has been received with the correct supporting documents, Enterprise Singapore will send your reimbursement money.

Onsite Audit Requirements

By receiving the PSG grant you are bound to comply with the relevant audit requirements to ensure you are using your solution for its intended purposes

It is at Enterprise Singapore's discretion when you will have to comply with an audit request after implementation of your new solution. Usually, audits will be raised one year after using the new solution.

It is best practice to keep all the necessary documents as proof of your purchase. Documents such as the receipt, invoice and quotation should be retained. The hardware / software that was purchased should also be kept, along with proof of your PSG grant. Even if you have decided to cease operations with your solution provider, you should still keep these documents and items handy for a smooth audit process.