How Internal POS Security Features Could Save You From Thousands in Losses

What is POS security and how could it impact your business?

快速瀏覽

- Why is POS Security Important?

- Internal VS External POS Security

- How Big is the Risk of Internal POS Security Failure

- What are the Methods Used to Compromise Internal POS Security

- What POS Features can help You Improve your Internal POS Security

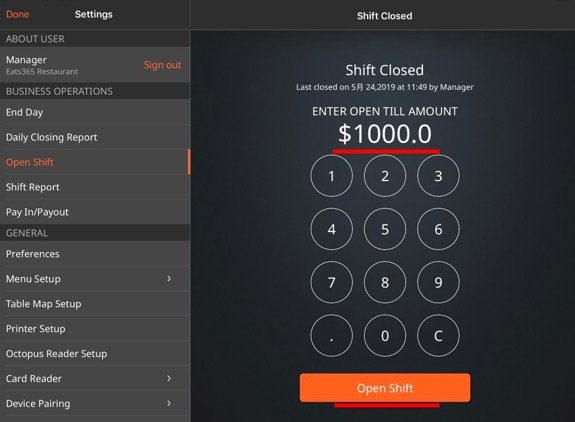

- Secure Cash Management

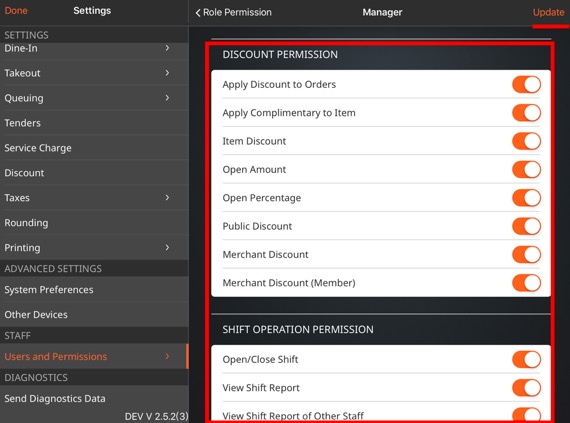

- Staff Permissions and Roles

- Account-Based Login

Why is POS Security Important?

A POS system is used to handle the most important aspects of any F&B business. Be it keeping track of orders, customer information or sales figures, the modern POS does it all. However, given the gravitas of what a POS system can do, there are ways that your POS can be compromised - both from within your organization and outside. A compromised POS system could lead to confidential data being stolen, hefty amounts in damages and even law suits; not to mention the downtime your business will face as the system is set right again. With this in mind, let's take a look at both, internal and external POS security.

Internal VS External POS Security

When most of us think of POS security, the first thing that comes to mind is being hacked externally and losing valuable business or customer data. While this is certainly a scary reality, perhaps the more dangerous threat could come internally; right from within your own business. In fact, "employees are responsible for about 48% of all shrinkage." This is where often-overlooked internal POS security comes into play. Many POS system providers do not provide internal security, but it is arguably one of the best ways to ensure your business runs smoothly and avoids unnecessary losses.

How Big is the Risk of Internal POS Security Failure?

To highlight the problem of a lack of internal POS system security, take into consideration that the 2019 National Retail Security Survey found that the average amount businesses lose per dishonest employee is $1,264 (USD). In the same survey, roughly 60% of employees were now thinking more about internal theft prevention. Now that we know about the potential damage that can be caused, how big is this risk? How likely is this type of behavior to occur within your own restaurant business? Well, it may already be occurring right under your nose as "employee theft comprises the highest percentage of retail shrink - more than that from traditional shoplifters or outside organized retail criminals." This is why it's so important to have POS features that help manage staff while also protecting your business.

What are the Methods Used to Compromise Internal POS Security?

All told, there are four main types of theft that can occur internally.

1. Theft of cash

2. Theft of credit card information

3. Theft of gift cards

4. 'Sweethearting'

While the first three types of theft are easy to understand, the fourth may not be known to too many people. Sweethearting occurs when "employees give free or discounted merchandise to friends or family. They accomplish this through cancellations -- "as is" items, returned items, discounted items, void/no transactions or manual entries."

What POS Features can help You Improve your Internal POS Security?

1. Secure Cash Management

2. Staff Permissions

3. Account-Based Login

Secure Cash Management

Having a POS that has built-in secure cash management is a must. Your POS system should be completely up-to-date with your business' financial situation from store opening to closing. Opening and closing each day, along with clocking in and clocking out must require employees to input the amount in the cash drawer each time. This feature can also be carried over to shifts, so that the amount of cash in the cash drawer is always accounted for per employee. Any discrepancies can be flagged early this way since managers will have access to the accounts and data, and will be able to perform daily checks to ensure that there are no strange fluctuations or losses of cash. By having secure cash management built directly into your POS system, staff will not feel like you do not trust them, whereas if you implement such measures separately, they may feel that they are not given the respect and trust they deserve. If this feature is already baked into your POS system, it's viewed as being just 'part of the system'.

Staff Permissions and Roles

Prevention is often the best way to avoid internal POS security breaches. One of the easiest methods of prevention is if your POS has staff roles and permissions as part of its system. What this feature does is limit functionality to just what POS operations various staff members require to get their jobs done. For example, if there are staff that simply do not need to use the cash register (like kitchen staff), when they log in to your POS, they will only have access to the features they need. They will not, for example, be able to create a new customer, make a sale, etc. Another basic permission could require managers to grant access before employees offer discounts or hand out gift cards. This way, employees will not be able to Sweetheart their friends and family at your expense.

Account-Based Login

Requiring all members of staff to log in when they use any POS in your restaurant ensures that all activities can be tracked. Should you notice any sudden decreases in cash, any strange sales or an abundance of discounts, you will be able to track these behaviors back to the account that authorized them. This level of security is simple, but can certainly save your business from having to guess which of your employees might be swindling you. If internal POS security is an issue you are concerned about, it is always best to have a manager, or someone you trust to look through the figures each night so you can catch any odd behaviour earlier rather than later.